A worldwide survey of project developers shows an extremely positive trend for the next few years. 62 plants with 331 MW are being planned – half of them in Europe. The Solar Industrial Heat Outlook 2023-2026 presents the results of the survey in a series of infographics. The Middle East and Southern Europe will be the main target regions for solar process heat (SHIP) activities in the coming years. In addition, the Outlook clearly shows that projects are getting bigger, more heat supply contracts are being signed and the proportion of systems supplying temperatures above 100 °C is rising sharply.

Thanks to more than 20 project developers from 13 countries sharing their project pipeline data, the German agency Solrico has been able to develop the first Solar Industrial Heat Outlook 2023-2026. The idea is to update this Outlook on a regular basis to show the dynamics in the global SHIP markets. Solrico would also like to raise awareness among policy and decision makers about the important role of solar heat in decarbonizing industry.

Customers, especially in the food, beverage, textile, chemical and automotive sectors, will rely on the sun for their energy supply, as the study shows. The following graphic lists the 62 announced projects by industry sector – divided according to the location of the client, within and outside Europe.

Large ESCO projects dominate the Outlook

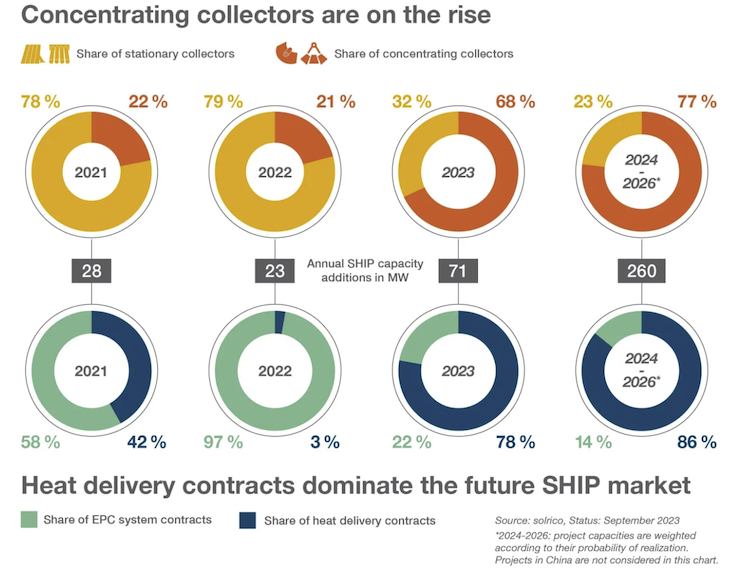

The Solar Industrial Heat Outlook 2023-2206 documents two fundamental trends. Many large SHIP plants with concentrating collectors are currently being planned. The share of concentrating collectors – and parabolic troughs in particular – will rise from the current level of around 20 % of the annually added SHIP capacity to around 70 % from 2023 onwards (see following infographic). Concentrating collectors also dominate in terms of the number of projects. 44 of the 62 announced projects for the period 2023-2026 (70%) use either parabolic troughs, Linear Fresnel or concentrating dish collectors.

The second trend concerns the business model. Whereas in the past the project developers only signed heat supply contracts with industrial customers in individual large projects, as seen in 2021, the share of the planned SHIP capacity under this business model will increase to well over 70 %. In the project database on which the Outlook is based, 21 projects have already been announced by Energy Service Companies (ESCOs), including systems with both stationary and concentrating collectors. This data shows that large ESCO projects dominate the Outlook.

Tripling of new SHIP capacity expected

Two facts about the methodology used to compile the Outlook need to be emphasized here. First, the forecast includes projects globally but excluding China because the information from there is difficult to verify. Secondly, the capacity of the announced SHIP projects is weighted according to the probability of realization. This means that projects are included in the Outlook with 30 %, 60 % or 100 % of their capacity, depending on the planning phase they are in.

The following graphic shows the growth in the global SHIP market (without China) from 2016 to 2022. The number of SHIP systems in operation doubled from 500 to almost 1,000 in the period under consideration. The capacity more than doubled from almost 300 MW to a good 700 MW. This is mainly thanks to the large-scale Miraah project in Oman, which went into operation in two phases in 2017 and in 2019 (light purple column section).

During the pandemic, the annual addition of SHIP capacity (orange column section) fell to between 20 and 30 MW. In 2023 the SHIP market will rise again sharply. According to the current planning status, 25 systems with 71 MW are to go into operation this year, which would be a tripling. Projects with a weighted capacity of an additional 260 MW have been announced for the period 2024-2026.

If one were optimistic and assumed that all announced projects would be fully implemented, then SHIP capacity globally would almost double again in the coming years, as the final graphic below illustrates. All 62 announced projects are included here with their full capacity.