Photo: Volkssolaranlage

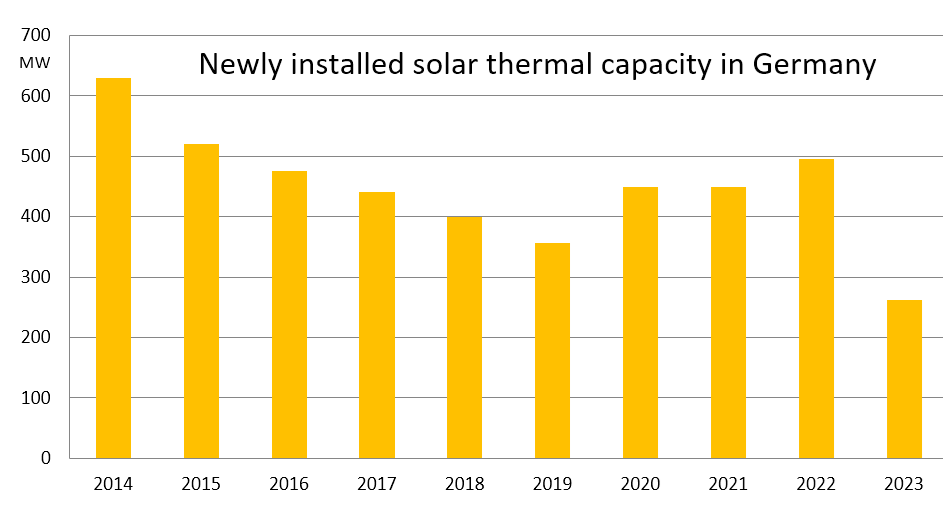

Fewer and fewer solar collectors are being bought in Germany: the negative trend from the previous year continued in the first quarter of 2024. Sales of solar collectors fell from just under 500 MW of capacity in 2022 to 263 MW in 2023 (see chart below). In previous years, the industry had recorded growth. However, some suppliers are defying the adverse conditions. They are recording stable sales figures in some market segments.

The two German industry associations BDH and BSW Solar had hoped for a turnaround this year. This hope has not been realized in the first few months of the year. On the contrary: “Things are going very badly, like in 2023,” said Michael Kinzel, Sales Manager at German solar collector and heat storage manufacturer Citrin Solar. Industry experts put the decline in the first quarter of 2024 at more than 50 % compared to the same period last year.

There are many reasons for the shrinking solar thermal market in Germany. “We used to have a lot of solar thermal energy in new buildings,” said Kinzel. But the new-building market segment has come to a standstill. Less and less is being built due to the economic situation. Another reason is the subsidies. Germany subsidizes solar thermal systems under the Federal Funding for Efficient Buildings (BEG) scheme with a basic subsidy rate of 30 %, which can rise to 60 % with additional bonuses and up to 70 % in combination with a pellet boiler or heat pump.

Despite these favourable conditions, the number of applications for funding has fallen in 2024. This is because responsibility for BEG funding was transferred from the Federal Office of Economics and Export Control (BAFA) to the KfW banking group at the beginning of the year. This led to an interruption in the possibility to submit applications. Since the end of February, single-family home owners have been able to submit subsidy applications again. For owners of rented properties this has been possible again since the end of May. Nevertheless, the process has led to uncertainty among consumers. There are few new applications for subsidies; the industry is mainly processing old applications from 2023.

Solar thermal market development in Germany: While it looked like the downward trend had been halted in 2020, the market slumped in 2023. One reason for this was the uncertainty among consumers caused by months of discussion about the Building Energy Act.

Source: BDH / BSW Solar

Hardly any retrofitting of solar thermal systems

People’s focus when renovating their heating systems has also changed. There is very little demand for solar collectors as a supplement to the existing heating system, observed Markus Beslmeisl, Sales Manager of the collector manufacturer Thermosolar in Germany. People almost always buy a completely new heating system. Solar thermal energy is often installed in combination with a biomass boiler. As the biomass boiler market also collapsed in 2023 due to the reduction in subsidies for pellet and wood-chip boilers, the solar thermal market is also suffering as a result.

Thermosolar is one of the pioneers in the industry and manufactures collectors in Slovakia. The company is asserting itself on the German market through a cooperation with the Austrian biomass boiler manufacturer Hargassner and benefits from the boiler manufacturer’s broad distribution network. Sales for Thermosolar are going very well in Austria in particular. According to Beslmeisl, this is due to the favourable subsidy conditions there for biomass boilers with solar thermal energy and the fact that the application process is simple and well-known. The situation is different in Germany: the application process is so complicated that heating system installers no longer do it themselves for customers as they used to. “Today, the plumber sends the customer to an energy consultant,” said Beslmeisl.

Photovoltaics in demand as a partner for heat pumps

In the long term, the solar thermal industry in Germany will have to deal with a structural problem. In new buildings, heat pumps dominate as a heating technology and these are very rarely combined with solar thermal energy. Due to the legislation in the Building Energy Act that new heating systems in existing buildings in Germany must also use at least 65 % heat from renewable sources from 2028 onward, heat pumps will also become increasingly important in existing buildings. However, the combination of solar thermal energy and heat pumps does not play a role on the market. “Heating system installers advise in favour of PV,” said Michael Kinzel. Using photovoltaic electricity for the heat pump is an obvious choice. The consulting effort to explain the advantages of solar thermal energy is too great.

Thermosolar has been offering a combination of vacuum flat-plate collectors and brine heat pumps for a long time. However, the company has given up its own heat pump production. “Technically, the combination of heat pump and solar thermal energy is excellent,” said Markus Beslmeisl. “We were simply too early.” Heat pump manufacturers are now focussing on standard solutions with air heat pumps. It is not easy to find a partner who wants to integrate solar collectors. Thermosolar is nevertheless working on solutions with air heat pumps. “We haven’t given up on heat pumps yet,” said Beslmeisl.

Trend reversal hoped for

The German solar thermal industry is hoping that the negative trend will be halted for the rest of the year. In the meantime, the federal government has raised the subsidy rate for biomass boilers again. It is also positive for solar thermal energy that the climate bonus for biomass boilers is only available in combination with solar thermal energy, allowing applicants to receive the maximum subsidy rate of 70 %. The number of subsidy applications also rose again in May and has now almost reached the previous year’s level.

Michael Kinzel from Citrin Solar is also focussing on expanding the large-scale systems segment. The company offers solar thermal systems for process heat generation. Citrin is cooperating with the Finnish large-area collector manufacturer Savosolar for large ground-mounted solar thermal systems. In addition to ground-mounted systems for process heat or local district heating, large-scale solar thermal systems for hotels, campsites, agriculture, breweries and laundries are doing well at Citrin Solar. So far, however, large-scale solar thermal systems are not yet sufficient to compensate for the losses in the single-family home segment, but Kinzel sees a positive future for this area.

There are currently 58 solar district heating systems with a total capacity of 114 MW installed in Germany. According to studies by the German research institute Solites, a further 13 collector fields with a total solar thermal capacity of 107 MW are currently under construction or in the planning stage. This market segment is increasingly developing into an important pillar of the German solar thermal market.

Photos taken from the brochure of Citrin Solar promoting large-scale solar thermal systems for housing industry, utilities and industrial clients Photos: Citrin Solar

Stable online trade

The online solar thermal trade in Germany appears to be stable. The company Bosswerk, which also operates the photovoltaic online retailer Greenakku, sells solar thermal systems with evacuated tube collectors under the brand “Volkssolaranlage” (possible translation: People’s Solar). The share of vacuum tube collectors in total collector sales has risen in recent years. Whereas in the past it was usually around 10 %, the proportion of vacuum tubes was already 26 % in 2022 and almost 29 % in 2023. Valentin Gensch, Technical Sales Manager at Volkssolaranlage, advises many customers. These are both end consumers and heating system installers. According to Gensch, interest in solar thermal energy at Bosswerk has not waned. 2023 was a great year. Volkssolaranlage has not seen a decline in the market at the start of 2024 either.

Manufacturers stick to production

The German collector manufacturer Solmetall can produce 370,000 solar collectors per year at its site in Spenge, North Rhine-Westphalia. This would have enabled the company to cover the entire German market in 2022. Will production still be worthwhile if quantities fall? “The market development has also left its mark on us, but we will definitely continue our production,” said Solmetall Managing Director Alexander Altemeier. “We saw a slight improvement in the situation in spring. However, I don’t expect any significant improvement in the next two years.”

Jens Peter Meyer