The world market for solar process heat (SHIP) continues to pick up speed. In 2023, the newly installed capacity tripled compared to the two previous years. The project developers reported 116 systems with a capacity of 94 MW. A year earlier there were also 116 systems but with only 31 MW of capacity newly commissioned worldwide. The growth was essentially based on two countries: The Netherlands led the world market 2023 with 43 new systems and Spain installed by far the largest SHIP capacity last year (49 MW). The proportion of concentrating systems grew strongly. Parabolic troughs, Fresnel collectors or concentrating dish collectors were used in 43 % of newly installed SHIP capacity. For comparison, this was only 16 % in 2022. The survey was carried out by the German agency solrico and supported by Natural Resources Canada. The photo shows a 600 m2 concentrating dish system for the food processor Moralejo Selection in Northwest Spain. The solar heat is used for cleaning purposes.

Photo: Kalido former TCT – Thermal Cooling Technology

Around 70 technology suppliers and project developers from 26 countries worldwide participated in this year’s SHIP survey. The data from the survey will be used to update the SHIP Turnkey Supplier World Map in the coming weeks. As part of the revision, the new plants will be added as references for the specific project developers and their portfolios will be updated. For all companies, there is information as to whether they produce collector technology and if so which kind, and whether they offer heat supply contracts.

The implementation rate of the SHIP specialists remained high. For 2023, 26 developers were able to report at least one completed project, at a similar level to 2022 with 25 companies. However, in preceding years there were only 19 (2021) and 17 (2020) companies with completions.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | End of year total 2023 | |

| No. of commissioned SHIP systems | 107 systems | 99 systems | 86 systems | 85 systems | 73 systems | 116 systems | 116 systems | at least 1,209 systems |

| Newly installed collector area | 219,280 m² | 55,583 m² | 358,641 m² | 132,316 m² | 51,866 m² | 43,664 m² | 134,990 m² | 1.359 million m² |

| Newly installed solar thermal capacity | 153 MW | 39 MW | 251 MW | 93 MW | 36 MW | 31 MW | 94 MW | 951 MW |

Table 1: Global SHIP market development between 2017 and 2023. The large fluctuations in added capacity were the result of large capacity additions in Oman and China in certain years. Four SHIP systems from 2021 and 2022 were added. Capacity was calculated using the factor 0.7 kW/m2 for all collector types. Source: Annual surveys between 2017 and 2024 of the companies listed on the Turnkey SHIP Supplier World Map: http://www.solar-payback.com/suppliers/

Top SHIP markets 2023: Netherlands, Mexico, Germany, China and France

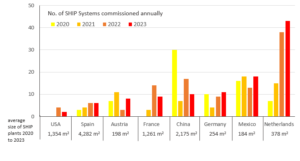

Figure 1 shows the ranking of the countries with the highest number of completed SHIP installations in 2023. The top five countries were Netherlands, Mexico, Germany, China and France. Countries with smaller plants on average clearly dominate here. The top European countries are primarily those that have implemented support systems: Netherlands (Sustainable Energy Production and Climate Transition Incentive Scheme – SDE++), Germany (Energy Efficient Economy), France (Ademe), Austria (Climate and Energy Fund) and Spain (European Regional Development Fund).

The Dutch system providers were able to exceed their top number of systems from 2022 (38 systems) and realized 43 systems in 2023, 37 % of the systems worldwide. However, providers expect demand to fall this year because the subsidy rates have been significantly reduced. The Dutch Ministry of Economic Affairs announced this shortly before Christmas. Consultations are now underway to see whether the reduction can be reversed.

In Austria and Germany the high number of SHIP projects in 2023 was mainly based on air drying systems for agricultural goods and wood – an application that has been included in both their national funding programmes in 2023. Also worth mentioning is the 1.5 MW vacuum tube collector system, which has been heating gas in a gas pressure regulating system since November 2023. After a five-year planning phase, this is now one of the largest SHIP plants in Germany.

Mexico and China have long been among the top SHIP markets, even without direct subsidies, but thanks to very cost-effective systems.

Figure 1: Top markets in terms of the number of new SHIP plants commissioned per year between 2020 and 2023. Source: Annual surveys of the companies listed on the SHIP Supplier World Map

Utility-scale systems in Spain

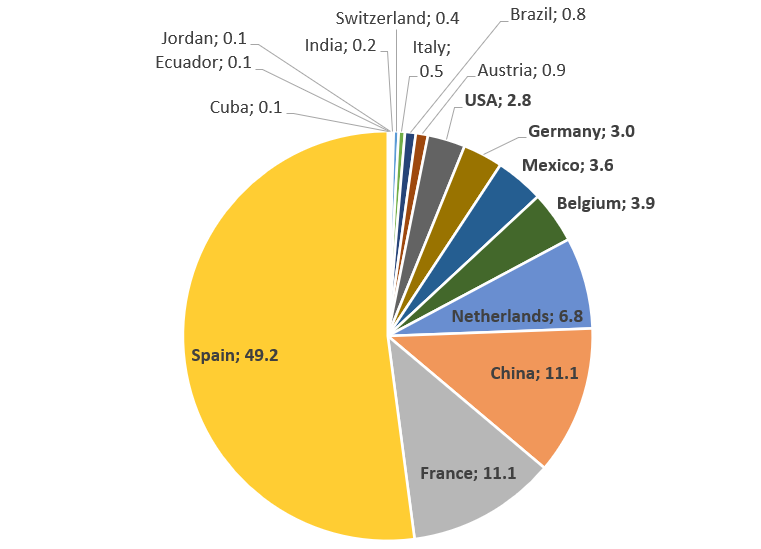

In order to fully assess the global SHIP market, you also need to look at Figure 2, in which the top countries are listed by newly installed capacity. Here Spain is far ahead of the rest with 49 MW, followed by France and China, each with 11 MW.

The good performance of the Spanish market in 2023 is due to the Thermal Energy Production grant scheme funded by the European Regional Development Fund in 2022. At that time, 51 commercial solar thermal projects with a total of 61 MW were awarded funding. Some really large projects from this funding round went into operation in Spain last year:

- 30 MW plant at the Heineken beer factory in Seville built with parabolic trough collectors by Azteq, Belgium

- 4.2 MW plant at the Heineken beer factory in Valencia built with Linear Fresnel collectors by Solatom, Spain

- 7 MW plant at L.Pernia animal feed factory in Seville built with unglazed air collectors by Solarwall Spain

- 7 MW plant at L.Pernia animal feed factory near Madrid built with unglazed air collectors by Solarwall Spai

A big success, even though many other projects of the same call for tenders were cancelled.

France knocked the USA off second place in the ranking in terms of the largest new SHIP capacity. This is the result of the commissioning of the 10.5 MW plant at the Lactalis dairy in Verdun. The French project developer New Heat has installed a flat-plate collector field there and operates it as an energy service company to provide preheating of fresh air feeding the main spray drying tower.

The US market disappointed in 2023 with only two new systems, although seven companies are listed on the SHIP world map. However, a larger system (2.8 MW) with flat plate collectors was commissioned last year at the metal can manufacturer Ball in California. The project was finalized jointly by Solid Solar Energy Systems from Austria and Tigi Solar from Israel.

Figure 2: SHIP capacity additions in 2023 in MW per country. In total, SHIP installations with 94 MW started operation worldwide last year. Source: Survey 2024 of the companies listed on the SHIP Supplier World Map

Trends in the Solar Industrial Heat Outlook confirmed

The first Solar Industrial Heat Outlook published in September 2023, described two fundamental trends: The share of concentrating collectors will rise and more developers will sign heat supply contracts, mainly for large-scale solar industrial heat plants. Both trends were confirmed by the current world market survey.

Six large-scale projects with a total capacity of 52 MW were realized in 2023 with heat supply contracts. The remaining plants were realized on the basis of turnkey delivery contracts. The share of solar thermal capacity realised as an energy service company model was therefore 55 %, which is significantly higher than in previous years (2 % in 2022 and 33 % in 2021).

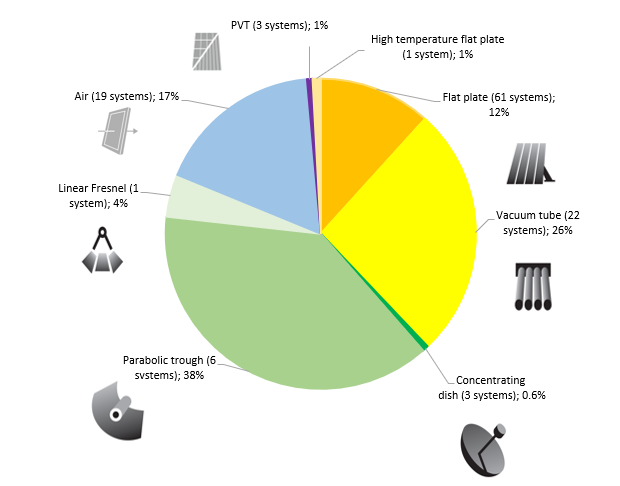

The trend towards solutions with concentrating collectors can be clearly seen in Figure 3. It shows the distribution of collector technology within the total newly installed SHIP capacity of 94 MW worldwide. The three concentrating collector technologies account for 43 % of the global market, significantly more than in 2022 when only 16 % of the global market was concentrating.

Although flat plate collectors were used in almost half of the world’s new projects (61 systems), their percentage share shrank to 12%. In 2022 it was still 39 %. Air collectors experienced great growth, accounting for 17 % of the global market last year (11 % in 2022). This was mainly due to the large projects in Spain, growth that will not necessarily be sustained in the next few years.

Figure 3: Distribution of collector type area in the SHIP world market 2023 (Total: 134,990 m2). Source: Survey 2024 of the companies listed on the SHIP Supplier World Map