ACWA Power's Noor Energy 1 CSP-PV project in Dubai combines optimized 15-hour CSP storage with demand-focused tariffs and supply chain efficiency to hit the record-low price of $73/MWh, project partners told the CSP Madrid 2018 conference.

ACWA Power has opted for 600 MW of parabolic trough capacity at its 950 MW CSP-PV project in Dubai. (Image credit: Masen)

Last month, Saudi Arabia's ACWA Power and the Dubai Electricity and Water Authority (DEWA) agreed to add 250 MW of PV capacity to the 700 MW Noor Energy 1 CSP project, previously known as DEWA CSP.

Developed by ACWA Power, the giant $4.4 billion project sets new records on scale and cost efficiency. The project includes three 200 MW parabolic trough systems supplied by Spain’s Abengoa and a 100 MW central tower plant supplied by U.S. developer BrightSource, plus 250 MW of PV. Awarded at a record-low levelized tariff of $73/MWh, the plant will host some 15 hours of molten salt CSP storage capacity and supply power 24 hours a day, 365 days a year.

Economies of scale, an optimized combination of technology and an innovative 35-year power purchase agreement (PPA) helped drive down project costs, partners told the conference on November 13.

Shanghai Electric is the contracted Engineering, Procurement, and Construction (EPC) supplier and the company has already begun limited works to meet a tight schedule.

Project financing is expected to be closed in the coming weeks and the plant is expected to be brought online in phases in 2021-2022, Rajit Nanda, Chief Investment Officer (CIO) at ACWA Power International, told conference attendees.

"Full notice to proceed is expected before Christmas," he said.

Storage focus

The $4.4 billion cost of Noor Energy 1 will be met by $2.9 billion of debt and $1.5 billion of equity. DEWA is to provide $750 million, half of the project equity. Of the remaining half, ACWA Power will provide 51% and China's Silk Road Fund 49%. Over 70% of the project debt will come from Chinese banks including Industrial and Commercial Bank of China Limited (ICBC), with the remainder supplied by international and regional banks.

The 35-year PPA for the project is around 10 years longer than typical arrangements, spreading the initial investment across a longer period and reducing the annual cost of capital.

DEWA's regulatory process also helped reduce costs, supporting optimizations to project design and financing and providing a comprehensive, bankable procurement framework.

The combined technology design optimizes storage capacity in order to produce power through the night and complement rising regional PV capacity. DEWA plans to build 5 GW of solar capacity by 2030, most of which will be PV.

The $73/MWh tariff consists of two layers of tariff “optimization,” reflecting the mix of technologies and regional demand profile, Nanda said.

The tariff for the PV compartment is set at $24/MWh and the tariff for the overall CSP plant is set at $83/MWh, levelized over the life of the PPA, he said.

For the CSP generation, tariffs are set according to time of supply.

From 10 AM till 4 PM in the seven-month summer period, DEWA buys power from the CSP plant at $29/MWh. At other times, DEWA pays $92/MWh.

"The whole design has been done to push a lot of resources towards storage during the daytime...and to rely more on PV for dispatch during the daytime," Nanda said.

There will still be "limited" dispatch of CSP during the summer daytime, when demand is highest, to recover some of the costs, he noted.

"From 4 PM onwards until the next day morning at 10 AM you get the full recovery of the tariffs, that's where storage is very critical-- you are able to fully optimize the storage and spread it over the maximum amount of generation," he said.

Bankable design

Launched in 2017, the CSP project tender called for twin parabolic trough-tower designs.

ACWA Power’s winning project includes a large portion of parabolic trough capacity as the technology has a longer track record and greater suitability to local climate conditions than tower technology, project participants told the conference.

The parabolic trough section will produce 74% of total power volume, while the tower will produce 14% and the PV compartment 12%, Nanda said.

In terms of revenues, 80% will be generated by the parabolic trough plant, 15% from the tower and 5% from the PV plant, he said.

The large portion of more proven parabolic trough technology helped to lower the financing costs, Nanda noted.

"The moment trough was brought in as a larger part of the overall hybrid, it brought about a completely different level of comfort," he said.

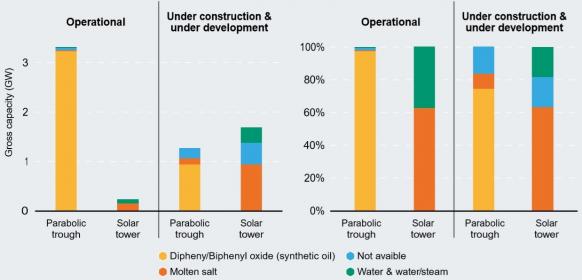

CSP technology types, heat transfer fluids

(Click image to enlarge)

Source: Irena report 'Renewable power generation costs in 2017.'

The solar attenuation levels on the site also favored a large share of parabolic trough technology, Gilein Steensma, Regional Director- EMEA New Energy at Advisian consultancy, said. Advisian, a Worley Parsons company, is acting as Owner's Engineer on the project.

The Noor Energy 1 plant will also benefit from auxiliary loads from PV capacity to reduce costs, Steensma said.

"It's quite an exciting combination of technologies that really responds to the meteorological conditions and the demand curve of Dubai," he said.

Construction costs

Shanghai Electric's experience as a plant supplier as well as an EPC contractor will allow it to drive for efficiencies in the supply chain. Shanghai Electric is one of China's top five power generators and has a total installed capacity of over 107 GW, including 5 GW of solar power and 10 GW of wind.

The global shift from feed in tariffs towards competitive tenders has seen developers dig deeper to reduce costs, Ranjan Moulik, Managing Director, Power & Renewables at Natixis bank, said. Natixis is working with ACWA Power on the Noor Energy 1 project.

"What we are seeing increasingly is sponsors and developers going down the value chain and speaking to the manufacturers themselves and squeezing out margins there," he said.

China’s pilot CSP program will also impact global markets, Moulik said.

China is deploying 1.4 GW of new CSP capacity under the program and the first 50 MW plant started commercial operations in October. As domestic expertise grows, Chinese groups are expanding partnerships overseas.

"We believe that the success of this [pilot CSP] program will result in further cost reductions in CSP technology," Moulik said.

Economies of scale on the Noor Energy 1 project will create additional project management and logistics savings.

The large orders placed for the project support innovative manufacturing and transport processes, Ana Cristina Gonzalez Una, Business Development Director at Abengoa, said.

"It's not only a matter of squeezing the suppliers, it's a matter [of thinking] a little bit out of the box and doing things different," she said.

Schedule pressure

Shanghai Electric is faced with the challenge of minimizing costs while also meeting a demanding construction schedule.

ACWA Power has issued Shanghai Electric a limited notice to proceed (NTP) and the entire plant is scheduled to be completed within four years of NTP, Nanda told the conference.

The first parabolic trough plant will go into commercial operation 32 months after NTP, and this will be followed by the commissioning of the tower plant at 35 months. The second and third parabolic troughs brought at 40 months and 48 months, Nanda said.

The combination of multiple plants will bring about construction synergies, but will also present logistics challenges that will put pressure on the project schedule, Una warned.

"We think we will need more than 30 containers per day arriving at the site, which means we have to have everything very well-planned, in terms of storage area, transportation, port facilities, etc," she said.