China has announced plans to start – and complete – 11 Concentrated Solar Power projects with thermal energy storage by 2024. The selected projects, with backing by some of China’s biggest energy giants, must now race to meet this very tight two-year deadline.

Out of China’s initial pilot program, from a planned 1.3 GW of CSP pilot projects by 2020, only 500 MW met the deadline on time. The pilot projects that did meet the deadline are now running and enjoying their 20 year power purchase agreements with a tariff of about 17 cents/kWh USD.

50MW Beam-Down CSP at Yumen, in Gansu Province, one of the pilot projects to take its technology to the new round IMAGE@Xinhua News

Tower technology emerged as the clear winner. Most of the pilot projects that made it through that very competitive initial program were tower. This suggests that China’s CSP future supply chain will comprise all the components for tower CSP.

Of the proposed tower projects, 6 of 9 came to fruition within the short 2 year timeframe required. Surprisingly, of the much more established and bankable trough technology, only 2 of the 7 proposed projects made the deadline, along with a less surprising quarter of the 4 proposed Fresnel projects.

According to CSP Focus founder and CEO, Sunny Sun, inability to find financing on time or at a good rate derailed more than half those pilot projects. This followed a similar trajectory in the US, where about half of the projects didn’t meet financing milestones in time.

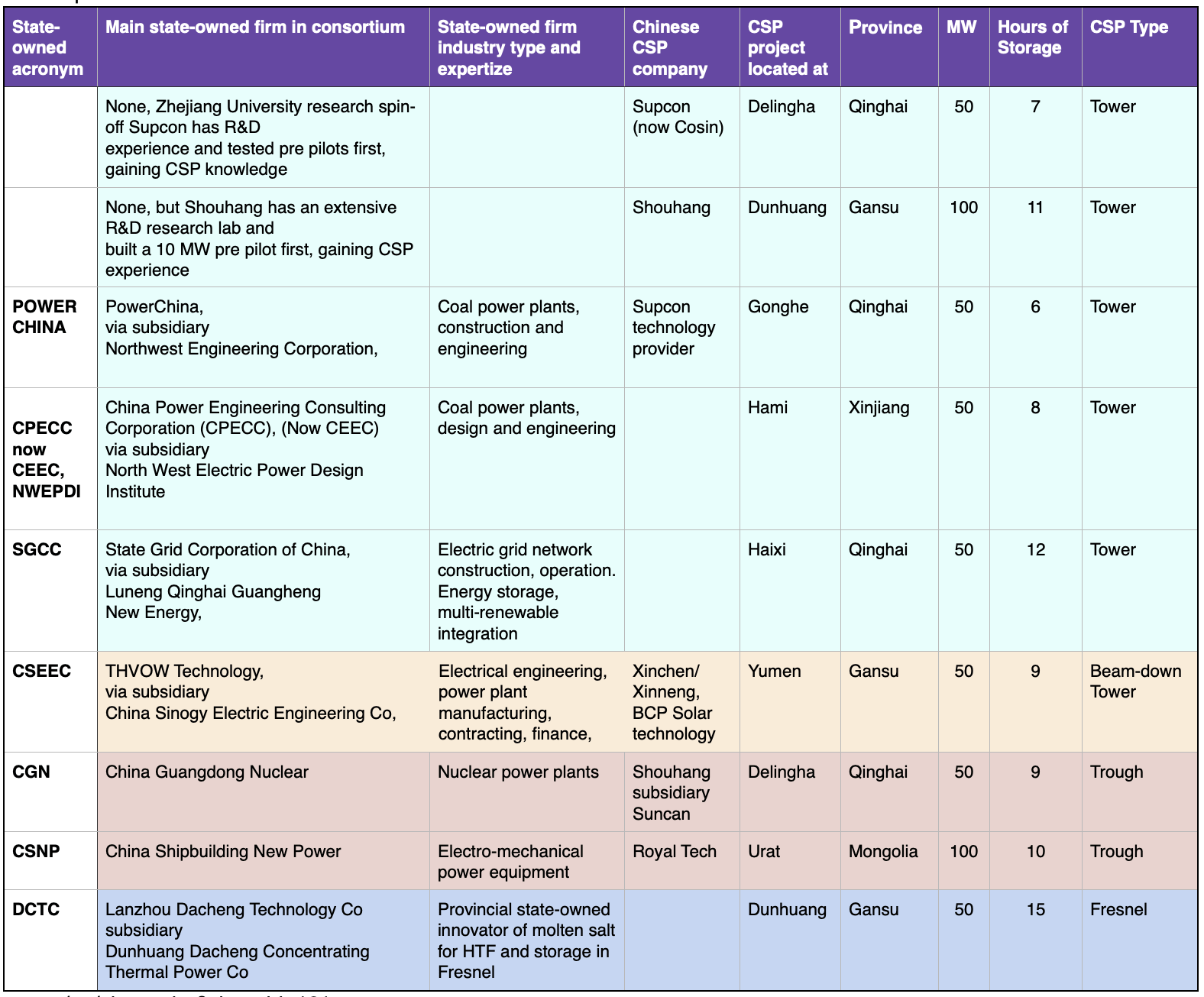

Huge state-owned firms to build China’s new CSP

In this next commercial round, each project will be developed by a consortium involving at least one large state-owned energy company, making it more likely that all the projects will have the financial wherewithal to be completed.

“These big firms are financially strong and they can get the financing from the bank, very easily, with very, very low interest rates,” Sun told SolarPACES in a call.

“Half of the pilot projects just stop moving because they cannot get the financing from the bank. Those halted projects were developed by and granted to private companies who were not able to provide enough equity or get low cost financing from banks by themselves alone, even though they know the technology very well.”

The very large state-owned firms involved in several of the tariff-based pilots and now the first commercial round include nuclear, hydropower, coal, oil and natural-gas fired power plant developers that have experience with the turbines and boilers in the power blocks that CSP technology has in common with these older energy forms.

Tower CSP in the foreground with Trough CSP in the distance

World’s largest energy firm to build two CSP projects

The largest clean energy investor and developer in the world; China Three Gorges Renewables (they built the 22.5 GW Three Gorges Dam) will develop two of these new 100 MW tower projects in Qinghai province, teaming up with Shouhang in one.

Two other state-owned energy firms (one a subsidiary of a state-owned oil company CNOOC) is teamed up for another tower with Cosin Solar (previously Supcon), one of the only two or three private developers that completed pilot projects on time.

“Firms like Supcon, Shouhang and Royal Tech CSP, they took the initiative and they are so brave to embrace CSP technology,” Sun remarked. “But in the end, I think, those state-owned energy companies like China’s Three Gorges Renewables or China Green Development Group will be the frontrunners. They have very rich experience in hydro, nuclear or coal power plants and now they are doing the CSP. And with these projects ahead, they will get the experience and references needed to explore more project opportunities worldwide .”

Shouhang and Supcon had also developed tower projects with no state-owned help, initially building smaller pre-pilot tests. Two of China’s pilots involved winners of the SolarPACES Annual Technology Innovation Awards; Royal Tech’s silicone-based heat transfer fluid and the Hami tower project’s Stellio heliostat. Both Shouhang and Supcon are research-based university spinoffs.

Pilot CSP projects operating in China as of December 2021 – Data from CSP Focus

This next commercial round must meet China’s 5 cent coal price

The first round included a set tariff – that declined for projects that met the two-year deadline late, causing late projects to have bank trouble and drop out. The new round sets a market referent price – derived from the coal price in that province – which varies – it is cheaper in Gansu than in Qinghai, for example. This coal price benchmark price is equivalent to around 5 cents/kWh.

The first round focused just on CSP (all with thermal energy storage) to de-risk the technical challenges of this technology. Only two of the five projects that got built in the US included thermal energy storage and one was felled by technical failure. But for this next round, CSP with storage will be developed as part of gigawatt-scale mixed-renewable energy projects along with PV and wind. The government simply announces the needed gigawatts of capacity in each region and developers bid to meet however many gigawatts are needed.

Instead of proposing 100 MW CSP projects alone, developers are proposing multi-renewable projects that add up to several gigawatts in total by combining CSP with storage with local PV and wind, that have already been scaled and are now the cheapest in the world with fully developed supply chains. CSP is not yet in that position in China, but is on its way.

1.1 GW of Chinese CSP to win bids for 2024 – Data from CSP Focus

Sun believes that if all these new projects get up and running over the 20 year contract, that will create an entire Chinese supply chain for CSP, and reduce its costs.

“The problem of CSP is we do not have many projects in operation yet,” he said. “We only started 20 pilot projects and only half of them got built. Now I think we have the capability, but we don’t have the economy of scale yet.”

As can be seen in the NREL listings of global CSP projects at SolarPACES, China has begun this local supply chain for CSP. Almost all of the listed suppliers of standard power block items like turbines, and even to a lesser extent, even the solar components like heliostats are Chinese.

Although the deadline is really tight, Sun pointed out that these new projects were already under preparation years ago, and had the necessary permissions in terms of land, environment, and even financing arrangements, before submitting the bids and winning the auctions. All of these projects must complete the construction and installation and connect to the grid at full load within two years.

“It’s different from China from West,” he explained. “Maybe you take another half a year for optimizing afterwards.”

The short time that the Chinese pilot projects took to ramp up was also much faster than in the CSP projects elsewhere. Rather than the three or more years that CSP has taken to optimize in other countries, several of China’s first round of successful pilot projects, including from Shouhang and Supcon, have taken as little as a year after grid connection to reach projected generation, despite their full scale.

So how likely is it that coal and nuclear developers would build renewables?

China’s new CSP projects will be built as part of gigantic gigawatt-scale renewable projects, comprising mostly now very low cost PV and wind. How this impacts CSP development depends on whether these massive firms overlook the storage benefits of CSP.

They will definitely build out gigawatts of PV and wind, as already cheaper-than-coal renewables. But the CSP might be more at risk. Sun is concerned that to stabilize PV and wind that can already be built below the coal price of 5 cents, they might be tempted to just add battery storage – and ultimately be forced to default back to fossil fueled peaking plants for longer duration, greater capacity storage. The next few months will reveal their decision.

“If the state-owned energy companies do turn their eyes on CSP then I do believe most of the new CSP projects for 2023 can happen,” he said.

“But if they do nothing for the next three, four months, they definitely will not complete CSP projects within the deadline. So these next months are very, very critical. But all these companies do have some kind of caveat. They have to meet the targets for national carbon emission to reach peaking in 2030. So they will, you know, think of new kind of alternatives such as PV, wind, biomass, hydro and also CSP.”

It may seem implausible that big coal plant developers would lead a nation in developing renewable energy, but in Norway and Denmark, state-owned oil firms Statoil and Danish Oil & Gas (DONG Energy; now Orsted) were similarly required to meet government targets and they have developed into world-leading offshore wind developers. Perhaps having state-owned energy gives a government more say in making the necessary climate transition.

Sun noted that the 2030 and 2060 climate targets that China has set require rapid gigawatt-scale changes starting immediately to supply enough 20 to 40-year power generation cycles. With electricity generation of over 8 million GWh annually China needs to get far more renewable energy online to meet these deadlines than any other nation. So is the pressure to meet carbon targets felt by these state-owned firms?

“Yes, I think this is the case, because if they fail to meet their emission target, definitely the whole national carbon neutralization target will be at risk,” Sun commented.

Susan Kraemer. solarpaces.org